LOWERING YOUR PREMIUM: WHAT’S BEHIND MY WORKER’S COMPENSATION RATE?

IN THIS BLOG

WHY DOES MY WORKERS COMPENSATION INSURANCE RATE IS SO EXPENSIVE?

UNDERSTANDING WORKERS COMPENSATION PREMIUM CALCULATION

WORKERS COMPENSATION INSURANCE PREMIUM BASED ON $100 OF PAYROLL.

HOW TO LOWER MY WORKERS COMPENSATION PREMIUM RATE?

HOW MUCH IS WORKERS COMPENSATION FOR SMALL BUSINESSES?

BUSINESSES WITH A HIGHER RISKS PAYS MORE FOR WORKERS COMPENSATION

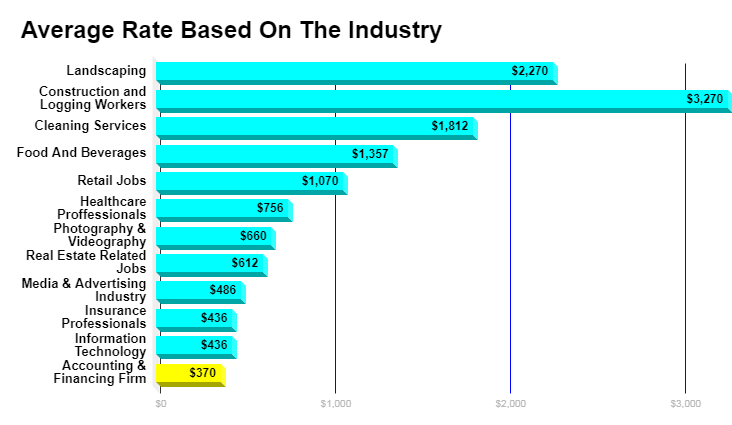

AVERAGE WORKERS COMPENSATION RATE BY INDUSTRY

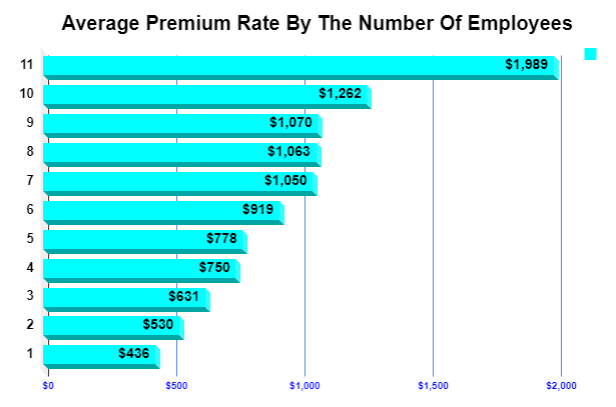

PREMIUMS BASED ON THE NUMBER OF EMPLOYEES

WHY DOES MY WORKERS COMPENSATION INSURANCE RATE IS SO EXPENSIVE?

Determining the annual workers’ compensation rate of a business can sometimes be tricky. Every insurance company charges businesses differently from other insurance providers. Workers’ compensation insurance rate varies from different factors, specifically with the classification of the business. Examples of these factors are your annual payroll, underwriting programs, or discounts that the business might be eligible for and the company’s prior claim history.

Additionally, every worker of the business is not responsible for paying the workers’ compensation insurance of their employers. This particular program is just a portion of the employer’s expenses on protecting its business. Therefore, no business owner is entitled to ask its employees for help in paying its insurance policy premium. However, the benefits of workers compensation insurance could only be given to employees that are working on the business as a regular worker. Furthermore, the worker’s working hours of the employees are not eligible to be used to prohibit them for the privilege of the benefits of workers comp.

UNDERSTANDING WORKERS COMPENSATION PREMIUM CALCULATION

The premium of workers compensation insurance is calculated based on this formula:

RATE X (PAYROLL/100) X EXPERIENCE MODIFIER = PREMIUM RATE OF THE POLICY

Generally, there are a lot of factors that could determine one business workers compensation rate, specifically, the classification of the business. The purpose of the business classification system is to distribute the cost of insurance, equally among employers with the same type of business. This process is generally used to make sure that the company with a higher risk of loss has to pay a higher premium than companies with lower risks. For example, a roofer contractor business is not eligible to pay a premium, the same as the online telemarketing business’s premium. Meaning, companies with the same working operations are labeled with the same classification. In general, the classification system is used to label the nature of the businesses —and not the worker’s risks.

1. CLASSIFICATION SYSTEM

Classification systems came from the ideology that businesses that have the same working operations are prone to experience similar types of risks and injuries. For example, employees working on concrete construction are subject to suffer injuries due to broken bones, ankle injury, knee injury, and spinal cord injury. The types of damages one concrete construction worker could incur, are comparatively the same as from one worker to another construction worker. Therefore, all businesses that the main operation is about concrete construction —will generate the same classification code.

2. EXPERIENCE MODIFIER

An experience modifier is not only used on this particular insurance. Generally, it is also included in the factors that could affect your commercial auto insurance premium and general liability insurance premium.

UNDERSTANDING EXPERIENCE MODIFIER

Insurance modifier is a numeric representation of the loss of the business, in comparison with the average loss for your industry. If the loss history of the business is average, the modifier would be 1.00. If the business has a loss history that is lesser than the average, the modifier will result in lower than 1.00. Likewise, if you have a bad loss history, your modifier would probably result in higher than the average of 1.00. Thus, if your modifier is lower than the average, your premium will reduce. Therefore, if your modifier is higher than the average, your premium will increase. For example, your modifier is .80, your payroll is $800,000, and your rate is $.15. Your premium would be $960.

WORKERS COMPENSATION INSURANCE PREMIUM BASED ON $100 OF PAYROLL.

One of the major components of calculating workers’ compensation premium is the payroll. The payroll is divided by 100, and the result would be multiplied by the classification rate. For further illustration, suppose the payroll is $1,000,000, and your rate is $.15. The payroll divided by 100 is $10,000 ($1,000,000/100). Your rate $.15 multiplied by $10,000 is $1,500.

HOW TO LOWER MY WORKERS COMPENSATION PREMIUM RATE?

1. LOWER YOUR MODIFIER TO LOWER YOUR PREMIUM

The business could not prevent any accidental losses that could happen to its working operations. However, you can always reduce your premium rate by taking precautionary measures to lower your risks and your modifier.

2. SAFETY FIRST

Maintaining a safe workplace could help both your premises and your employees reduce any occurring injuries. Enroll your employees for safety training and seminars. Your modifier multiplies the calculation of your premium. Therefore, a small reduction of your possible losses could result in notable savings.

3. DEVELOP A RETURN TO WORK PROGRAM

If an email sent from your server has a virus that crashes the system of a customer, or the software your company distributes fails, resulting in a loss for a third party, you could be held liable for the damages.

4. ENROLL IN STATE-SPONSORED PROGRAMS

Enrollment in some State-Sponsored programs could reduce your workers’ compensation insurance rate. For example, some states offer a reduction to the premium if the business participates in a Drug-Free workplace program.

5. REVIEW THE BUSINESS PAYROLL FIGURES

Workers Compensation insurance rates are also based on the payroll of your business. If the corporation declares a high payroll, the company could significantly garner a higher premium rate —than the business should have. Therefore, stating the exact figure of your payroll is a must.

6. HAVE A FIRST AID TRAINING

It is more significant if one of your employees or you as an owner, has first aid training. First aid is immediate care that could be given to an injured person —to prevent any injuries from worsening. Therefore, injured employees will not take a long time to stay at home for the recovery.

HOW MUCH IS WORKERS COMPENSATION FOR SMALL BUSINESSES?

The business workers’ compensation rate is based on the location of your business, and the business’s annual payroll. Insurance companies often base workers’ comp rate, based on the industry of the business and its claims history. Often, jobs that require the worker to use its physical strength usually gets a higher premium rate —so does, if the workplace has a history of loss claims. Additionally, the physical location where your employees work is also a significant factor that could affect your workers’ compensation rate. For example, in Texas, the per $100 limit will only cost you $0.60, and $3.00 in Alaska.

BUSINESSES WITH A HIGHER RISKS PAYS MORE FOR WORKERS COMPENSATION

Hazardous work such as physically challenging occupations often pays more for workers’ compensation. Additionally, in California, 30% of the workers who incur death during the course of its work are from physically challenging jobs, specifically construction and logging workers. It is the reason that hazardous works generally incur a high premium rate. Likewise, if the business only involves a clerical job, including an accounting firm or finance firm —it will only get a low premium due to its minimal risk of incurring work-related injuries.

AVERAGE WORKERS COMPENSATION RATE BY INDUSTRY

AVERAGE WORKERS COMPENSATION RATE BY INDUSTRY

There is a significant connection between the workers of the business and the business’s workers’ compensation premium. Generally, the more employees you have, the higher the premium you will pay.

There is a significant connection between the workers of the business and the business’s workers’ compensation premium. Generally, the more employees you have, the higher the premium you will pay.